Many individuals, together with rationally ignorant voters, ignore the poor state of the US authorities’s funds. The Desk under offers some numbers, extracted from the final finances of the US authorities. Politicians ought to pay attention to the issue, however their self-interest is to kick the can down the long run and compete for the perks of energy by promising voters new applications, transfers, and tax cuts (see James Buchanan and Richard Wagner’s 1977 guide Democracy in Deficit: The Political Legacy of Lord Keynes).

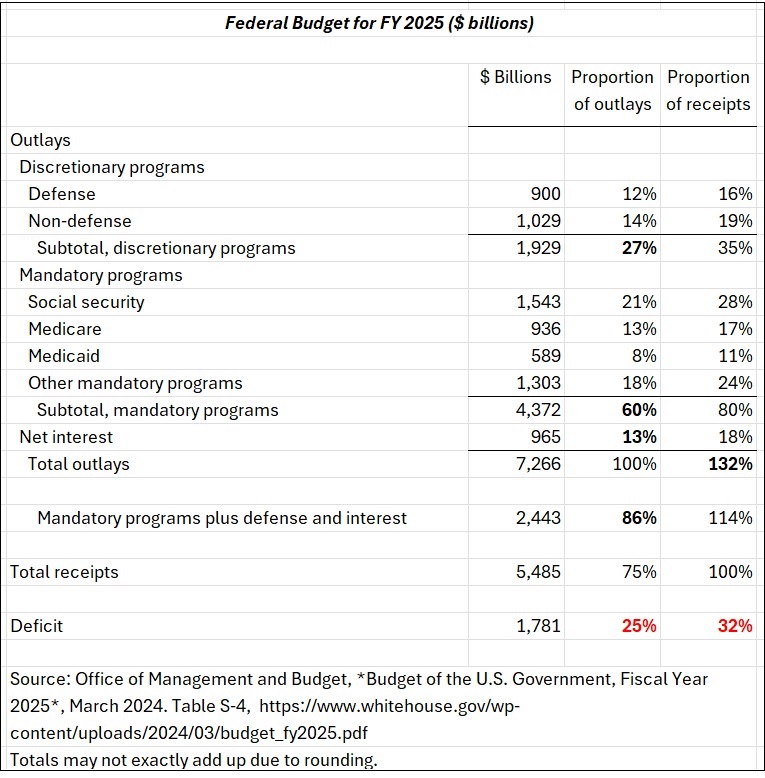

If Congress appropriations comply with the finances of March 2024, outlays (spending) for FY 2025 (October 1, 2024 to September 30, 2025) will attain $7.3 trillion in contrast with forecasted receipts (revenues) of $5.5 trillion. A deficit of $1.8 trillion will consequence. Subsequent 12 months, then, the federal deficit is about to equal 25% of spending and 32% of receipts (the figures in purple on my Desk).

This stage of annual deficit has turn into fairly typical. Federal spending reached $1 trillion in 2019, peaked at $3.1 trillion in 2020 and, after the epidemic, receded to a median of $1.9 trillion from 2021 to 2024.

The issue shouldn’t be brought on by annual emergencies or enthusiasm, nor by random “government waste.” Sixty p.c of federal spending known as necessary, for it’s made of huge applications mandated by standing legal guidelines and laws and never topic to annual appropriations by Congress. The necessary applications are basically Social Safety, Medicare, and Medicaid. The “other” class primarily contains revenue safety applications similar to unemployment compensation, diet help applications, or Supplemental Safety Earnings.

The a part of federal spending referred to as discretionary (27% of spending) contains $900 billion for protection plus annual appropriations by Congress for all different functions.

To those two broad classes of spending have to be added almost $1 trillion (13% of spending) for curiosity funds on the general public debt. Curiosity funds diminish when the speed of curiosity decreases, however improve with the rising stage of debt.

Including to necessary applications the outlays for protection and curiosity on the general public debt, which aren’t simply or readily compressible both, we get 86% of complete outlays. Thus, solely 14% of federal spending is compressible or “discretionary” on this sense. Eliminating the annual deficit with out rising taxes would require the elimination of all these “discretionary” outlays plus an 11% discount in “non-compressible” expenditures (necessary applications, protection, and curiosity on the general public debt).

Since 1961, the OMB’s historic finances tables (see Desk 7.1) present a surplus in solely 5 years: 1969, and 1998 to 2001. The issue is clearly not a operate of which political occasion is in energy. Persistent deficits clarify why the federal debt held by the general public is predicted to succeed in $30 trillion on the finish of FY 2025, greater than twice the $14.2 trillion on the finish of President Barack Obama’s second time period.

The general public debt is a time bomb that should be defused or will explode sooner or later. If giant will increase in taxes or default on the general public debt are to be averted, a elementary reassessment of the federal authorities’s capabilities and scope will probably be wanted.

******************************

The federal government sinking in debt