The outdated noticed that markets climb a wall of fear is alive and kicking. Though there are many warnings from analysts who see bother forward, development profiles present no worry, by way of a number of pairs of ETF proxies for profiling the urge for food for danger, based mostly on costs by means of yesterday’s shut (Might 22).

What some see as a gravity-defying run larger extends related profiles from earlier this 12 months (see right here and right here). The get together should finish ultimately, as all bull runs do, however for the second the bias for risk-on stays conspicuous.

Be taught To Use R For Portfolio Evaluation

Quantitative Funding Portfolio Analytics In R:

An Introduction To R For Modeling Portfolio Danger and Return

By James Picerno

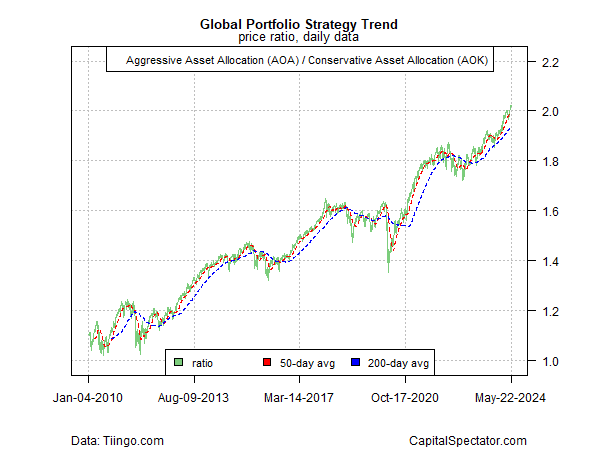

The online-positive bias nonetheless appears sturdy usually by way of an aggressive international asset allocation portfolio (AOA) vs. its conservative counterpart (AOK). Firstly of the buying and selling week this ratio touched a brand new document excessive earlier than edging down on Tuesday and Wednesday.

The US equities market isn’t fairly as scorching as AOA:AOK, however its shut, based mostly on the ratio US shares (SPY) vs. a low-volatility subset (USMV).

A key bellwether for shares lately is the semiconductor trade (SMH), which is on observe to rise for a fifth straight week. Relative to the broad market (SPY), this ratio appears set to succeed in a brand new peak quickly.

A potential early warning signal that the bulls have gotten drained is the latest drop in housing shares (XHB) relative US equities total (SPY). This ratio has fallen in latest days, closing yesterday on the lowest stage since February.

In the meantime, the latest rally in medium-term US Treasuries (IEF) vs. shorter-term counterparts (SHY) is stalling once more, suggesting that the long-running bear market in bonds has but to run its course.

A probably worrisome signal for the general danger urge for food is the rebound in inflation-indexed Treasuries (TIP) vs. typical authorities bonds (IEF). The market seems to be flirting with a brand new run of reflation, however remains to be on the fence. This ratio stays properly wanting its earlier peak in October. If and when TIP:IEF units a brand new excessive, it will sign bother for animal spirits.