Catching up with the newest from the monetary world is a crucial a part of staying up-to-date with market traits, financial adjustments, and openings for funding. Enter Wirex and Visa, a match made in heaven for these trying to revolutionize digital transaction processing.

The Energy of Partnership

Wirex is acknowledged for its cutting-edge Web3 cash app, whereas Visa has been a front-runner in digital funds worldwide. Their joint goal, in keeping with their current announcement, is to additional the event of digital currencies throughout the UK and the European Financial Space to make clean and guaranteed digital funds.

This partnership represents a landmark in options for the worldwide motion of funds, making certain seamless transactions and environment friendly financial motion between crypto and traditional fiat currencies.

Why This Partnership Issues

Merging Visa’s trusted fee community with Wirex’s revolutionary merchandise ensures the seamless administration of cryptos and conventional currencies, sustaining quick and environment friendly transactions. Furthermore, Visa’s licensing of Wirex for card issuance and its principal membership within the Visa Community additional exemplify Wirex’s pioneering position within the monetary companies sector.

Cuy Sheffield, Head of Crypto at Visa, stated, “Partnering with Wirex to help integrate blockchain technology with traditional finance, including the launch of Wirex Pay, aligns closely with our vision for the future of payments while highlighting the importance of collaboration in driving fintech innovation.”

Introducing Wirex Pay

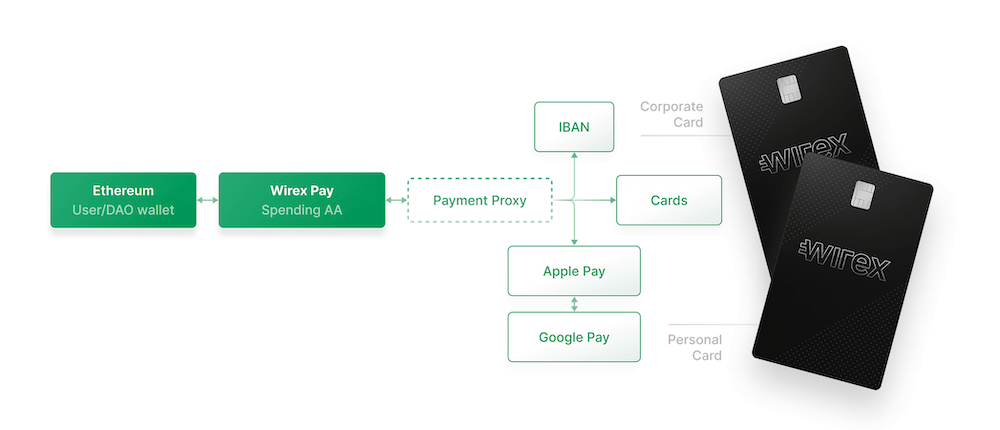

Some of the thrilling deliverables from this partnership is the launch of Wirex Pay. This modular Zero Information (ZK) fee chain pioneers a brand new technique to handle and spend each digital and conventional cash. It’s designed for strong options for international funds motion, making transactions efficient and user-friendly.

One of many only a few fintechs licensed by Visa to difficulty playing cards, Wirex Pay underscores the potential of the fintech enviornment to bridge the hole between blockchain know-how and conventional finance.

As a licensed Visa crypto-native agency, Wirex paves the way in which for the creation of a complete array of options for transferring cash on a worldwide scale—that is the bottom of a monetary world transitioning into Web3 and decentralization.

Ease of economic transactions is only one half; clearly, it’s going to lead to smoother and more practical monetary interactions. This might be a game-changer for somebody eager to combine crypto into their life-style.

Conclusion

Wirex can use Visa’s principal license, making a seamless transaction between blockchain know-how and conventional finance potential. It presents customers safe accounts to carry, switch, and trade currencies.

This provides Wirex the distinctive means to outline rising traits inside Web3 and take step one in bringing mainstream entry to digital finance and wealth administration by being a principal member of each Visa and Mastercard.