“The pandemic and Covid variants remain one of the biggest risks to markets, and are likely to continue to inject volatility,” Keith Lerner, a strategist at Truist, wrote in a note to clients.

Mr. Lerner said a modest sell-off is hardly unexpected, given the heights at which stocks have been trading. “We are not making any changes to our investment guidance at this point,” he wrote, adding that consumers and companies are much more adept at dealing with virus restrictions now.

Futures of West Texas Intermediate oil, the U.S. crude benchmark, plummeted more than 13 percent to $68.04 a barrel, the lowest since early September. The price of oil has been especially sensitive to virus restrictions that keep people at home. The drop comes just three days after the United States and five other countries announced a coordinated effort to tap into their national oil stockpiles, to try to drive down rising gas prices.

Brent futures, the European benchmark, fell 11 percent to about $73 a barrel. But Mr. Ganesh said UBS forecasts that the price will rise to $90 a barrel by March, partly in the expectation that the fears about new virus restrictions will be temporary.

Demand for the relative safety of government bonds jumped, pushing their prices up and their yields down. The yield on the 10-year U.S. Treasury plunged 15 basis points, or 0.15 percentage points, to 1.48 percent, the biggest single-day drop since March 2020. The yield on Germany’s bund, Europe’s benchmark bond, fell 9 basis points to minus 0.34 percent.

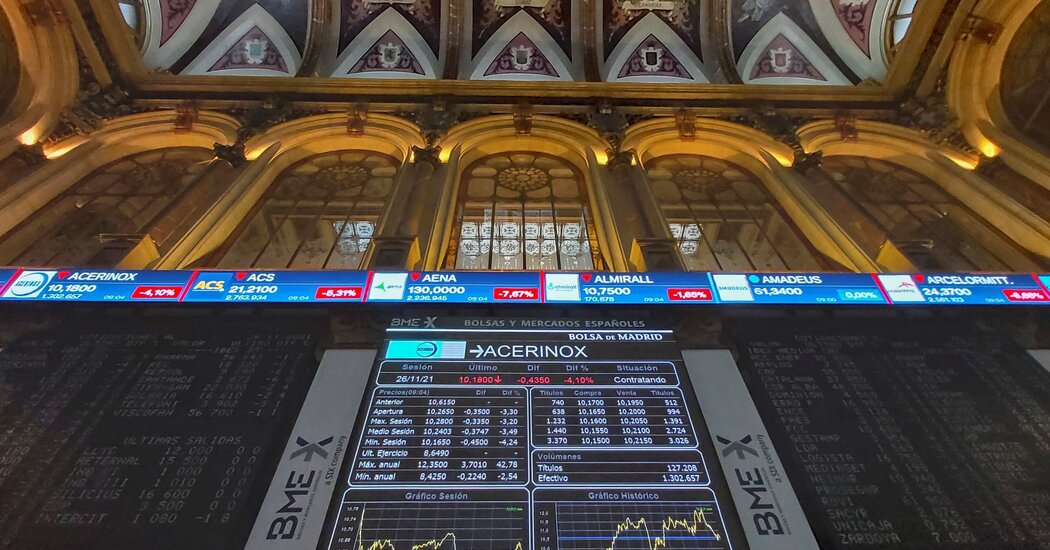

In an echo of the market fluctuations of last year, stocks that flourished under lockdowns and quarantines rose, including Zoom and Peloton. Companies vulnerable to travel restrictions, like Carnival, the cruise company, and Boeing, the plane maker, fell.

In Asia, the Nikkei 225 in Japan closed 2.5 percent lower and the Hang Seng Index in Hong Kong declined 2.7 percent.